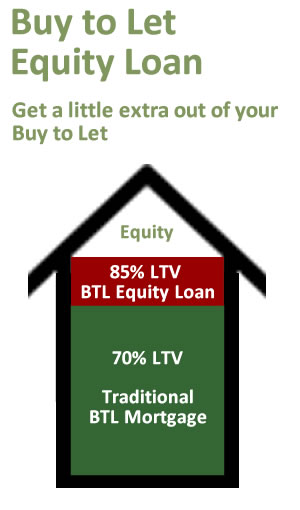

Stewart has a buy to let property worth £250,000, it is mortgaged for £182,500 (73% LTV). Stewart has seen another property that would make an ideal investment and needs a deposit of £30,000. However the maximum he can raise from his existing property is £5,000 which would take him to 75% LTV which is the maximum he can get from a standard buy to let mortgage.

He therefore takes £30,000 using our buy to let equity release product. This takes his total borrowing to 85% LTV of which 12% relates to the equity release product. Stewart buys his new buy to let property.

After 5 years property values have increased considerably and Stewart feels he can now afford to repay the loan. The property is now valued at £300,000 and so the amount Stewart has to repay is as follows :

The Original Sum Borrowed - £30,000

2 times the percentage borrowed (12% X 2) on the growth of the property (£50,000) which equals £12,000

This means the total to repay is - £42,000

While this may seem high, Stewart feels that he has owned an additional property for 5 years and benefited from the rental income during this period, likewise he did not have to make any regular repayments on the £30,000 borrowed. Being able to borrow in this way for 5 years has left Stewart financially stronger and he has been able to repay the loan without needing to sell either of his buy to let properties, thereby preserving a long term income generating asset.

While this may not be suitable for everyone, for customers in a similar situation to Stewart using our second charge buy to let equity release product could be an ideal solution.

If you would like to know more about taking further capital from your buy to let property, or property portfolio, then please contact us on 020 33 55 4837 where we would be happy to provide no obligation information, help and quotes. |